Excerpt

Legal and tax compliance may seem like backend formalities, but they play a critical role in protecting a business from risk. From contracts and regulations to accounting and taxation, compliance connects law and finance—ensuring stability, transparency, and long-term growth.

Full Article

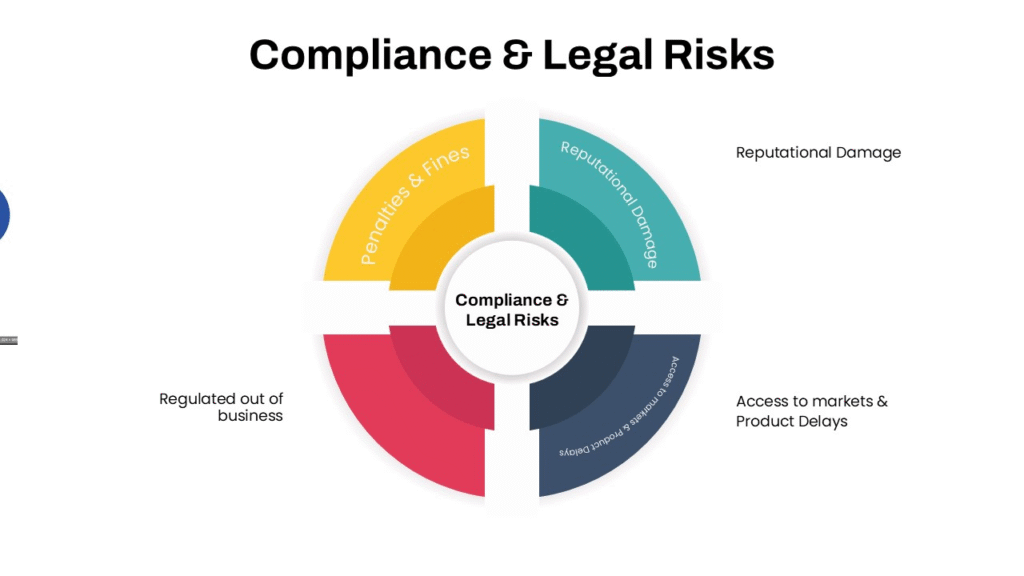

Every successful business operates at the intersection of law and finance. Legal compliance defines how a business must operate, while tax compliance ensures financial accountability. Together, they create a secure framework that protects organizations from penalties, disputes, and financial uncertainty.

Ignoring legal or tax obligations can lead to serious consequences—fines, audits, lawsuits, frozen accounts, or even business shutdowns. On the other hand, businesses that prioritize compliance gain clarity, credibility, and operational confidence.

From drafting contracts to maintaining accurate financial records, compliance transforms complex legal requirements into structured, manageable processes that support informed decision-making.

⭐ Why Legal and Tax Compliance Matters

✔ 1. Protects Against Legal Penalties

Adhering to laws and tax regulations prevents fines, notices, and enforcement actions.

✔ 2. Ensures Financial Transparency

Accurate records and compliant reporting improve financial clarity and accountability.

✔ 3. Strengthens Business Credibility

Compliant businesses earn trust from investors, customers, banks, and regulators.

✔ 4. Reduces Operational Risk

Clear legal and tax structures minimize uncertainty and unexpected liabilities.

✔ 5. Supports Sustainable Growth

Businesses with strong compliance systems scale more smoothly and securely.

⭐ Key Areas Where Law Meets Finance

🔹 Contractual Compliance

Well-drafted contracts protect revenue, intellectual property, and business relationships.

🔹 Tax Filing & Reporting

Timely and accurate tax filings prevent audits, interest, and penalties.

🔹 Corporate Governance

Compliance ensures directors, management, and stakeholders act responsibly.

🔹 Record Keeping & Audits

Proper documentation supports transparency and regulatory readiness.

🔹 Regulatory Disclosures

Mandatory filings keep businesses aligned with government requirements.

⭐ Tax Compliance: More Than Just Filing Returns

Tax compliance is not limited to paying taxes—it involves understanding obligations, maintaining records, and following reporting standards. Errors or delays can attract scrutiny and financial loss.

Proper tax compliance helps businesses:

- Plan finances efficiently

- Avoid last-minute stress

- Maintain clean audit trails

- Make informed strategic decisions